CNN —

Genetic testing service 23andMe said on March 23 that it filed for Chapter 11 bankruptcy protection — an effort to keep the company running while reorganizing its debts.

The company is navigating an uncertain future, as consumer advocates are urging its 15 million customers worldwide to delete their data to prevent it from being accessible to potential buyers.

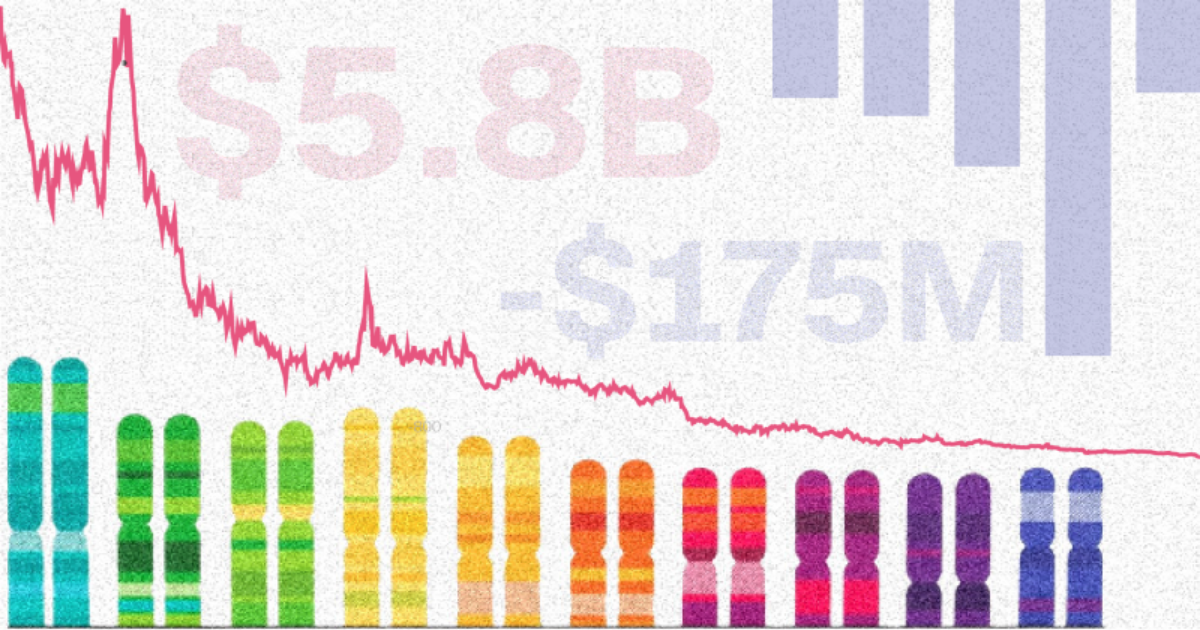

These are the latest challenges for the California-based company, founded in 2006, which dramatically cut its workforce last year and has struggled financially since it went public in 2021. Here’s a look at 23andMe’s rise and fall in four charts.

Just months after it started trading on the Nasdaq in June 2021, the company was valued as high as $5.8 billion. But by the end of that year, it had lost nearly half its value. Then, in 2023, hackers accessed profiles and genetic information on millions of users.

As of Friday, the firm’s shares were worth less than a dollar.

One of the company’s primary challenges is finding a sustainable business model.

Its core revenue comes from direct-to-consumer sales of saliva collection kits for genetic testing, priced from $99 to $499, with the higher end including optional subscription services. After customers buy kits and send in samples, most of the transactions are complete.

Although the cumulative number of customers has increased over the years, the growth has started to lag — and new subscriptions haven’t kept pace.

This has contributed to the company’s declining revenue and net losses that have gotten worse. Last year, the company cut 40% of its workforce and last week its CEO and co-founder, Anne Wojcicki, resigned.

In 2018, the company struck a four-year collaboration deal with pharmaceutical giant GSK “to gather insights and discover novel drug targets driving disease progression and develop therapies,” according to the London-based company’s website.

In addition to co-funding the activities within the collaboration, GSK invested $300 million in 23andMe. However, the company has never turned a profit since it went public in 2021 and reported a $666 million loss last fiscal year, according to its financial statements.

For the first nine months of fiscal 2025, which ended on Dec. 31, 2024, the company reported a $174 million net loss, according to those filings.

23andMe’s saliva-based testing goes beyond tracing ancestry. It can also reveal genetic predispositions to conditions ranging from diabetes to certain cancers. While this information can help customers with health-related decisions, it also raises privacy concerns – especially as the company faces a potential sale.

Many of the leading causes of death in the US are related to disease, according to the US Centers for Disease Control, making genetic information valuable and potentially vulnerable to exploitation, consumer advocates fear.

Last week, attorneys general in New York and California urged users to delete their data from the company.

California Attorney General Rob Bonta told ABC News that he struggled to delete his own information from the platform, suggesting the website glitches he encountered were evidence that hordes of customers were doing the same thing.

On the day of 23andMe’s bankruptcy announcement, there were 376,000 visits to the site’s help pages related to deleting data, and the following day there were 480,000 visits to those pages, according to web analytics company Simliarweb.

CNN’s Clare Duffy contributed to this report.