President Trump’s sprawling domestic policy bill has passed the House and Senate, and now awaits the president’s signature. Below, some answers to questions you may have.

This bill is truly enormous, in terms of its:

- Scope: There is no modern precedent for a bill that simultaneously cuts taxes and the social safety net while providing new spending for priorities like immigration enforcement.

- Tax cuts: $4.5 trillion over a decade, most with no expiration date. A major goal was to extend the Trump tax cuts that were passed in 2017 and set to expire, but the cost to the government is higher this time.

- Spending cuts: $1.7 trillion, including a 12 percent cut to Medicaid, an unprecedented reduction in spending on the federal-state health insurance program for poor Americans.

- New spending: $450 billion, including a 150 percent boost to the Immigration and Customs Enforcement budget over the next five years.

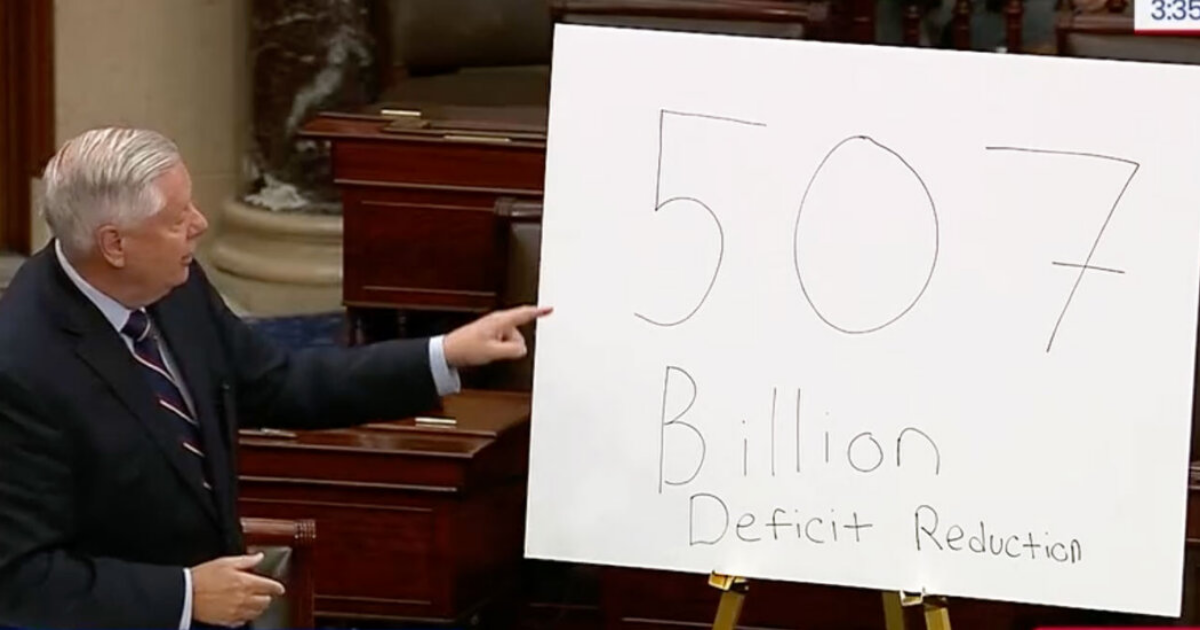

- Contribution to the federal debt: Nearly $3.4 trillion as written ($4.1 trillion including interest), and $5.5 trillion if temporary provisions are extended. That’s more than the combination of the 2022 CHIPS Act, the 2021 infrastructure act and the two largest Covid relief bills.

- Number of provisions: 309. Among them are a new $250 fee for the issue of student or worker visas and a $1,000 government contribution to tax-advantaged savings accounts for babies called “Trump accounts.”

A lot depends on your individual circumstances. Do you have a parent in a nursing home who uses Medicaid? Do you have a child who is going to need a student loan? Do you make a lot of money in tips? Do you plan to put solar panels on your roof? The bill has provisions that affect all of these things and many more, some positive, some negative. In general, most Americans will pay less in federal income taxes under this bill than they would if the tax cuts passed in 2017 were instead allowed to expire.

But Americans at the bottom of the income spectrum will see many of their benefits cut. Most poor Americans don’t pay federal income taxes and won’t get a boost from the tax cut. The bill reduces spending on food assistance and Medicaid, which many poor Americans rely on.

Thank you for your patience while we verify access. If you are in Reader mode please exit and log into your Times account, or subscribe for all of The Times.

Thank you for your patience while we verify access.

Already a subscriber? Log in.

Want all of The Times? Subscribe.