(Bloomberg) — For months, Wall Street brushed off Donald Trump’s trade war and the Federal Reserve’s higher-for-longer stance — confident a resilient economy would keep propping up US markets.

Most Read from Bloomberg

This week, that confidence began to unravel. Weak job growth and Trump’s latest volley of tariffs rattled investors, intensifying pressure on Fed Chair Jerome Powell to lower interest rates and exposing a new unease with the White House’s protectionist push.

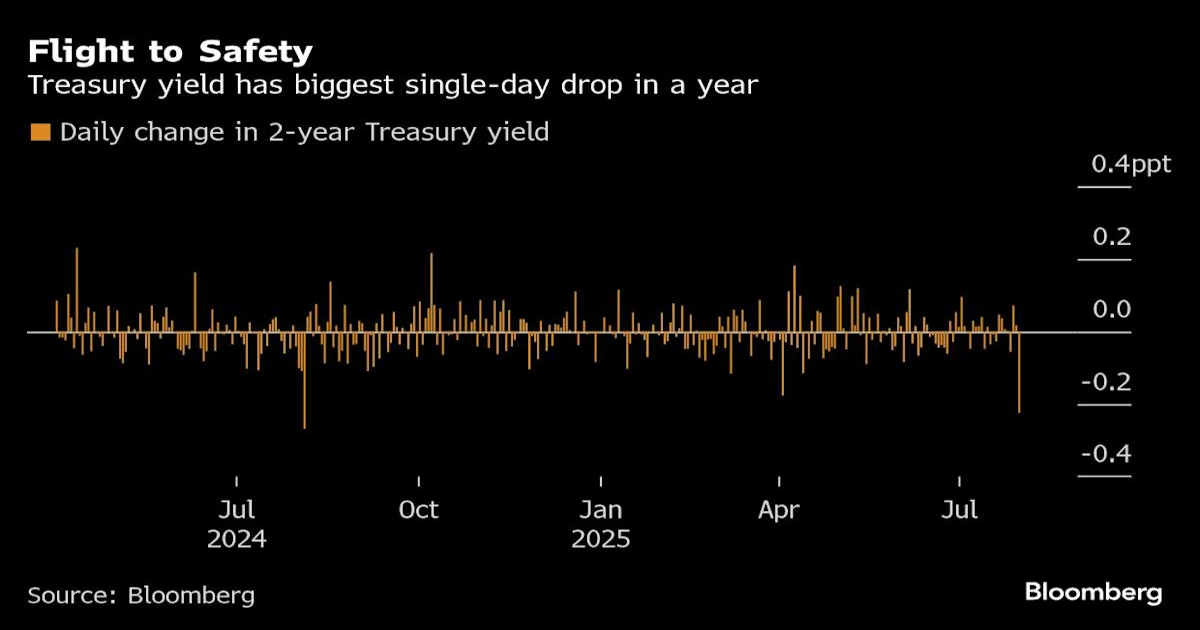

A three-month stretch of nearly unbroken market calm was shattered on Friday after a US report showed a sharp slowdown in the labor market. Traders rushed into the safety of government bonds — pushing down yields on two-year notes to 3.71% in the biggest drop since last August — while ramping up bets for a rate cut next month. The dollar fell and the S&P 500 Index continued a retreat from an all-time high, poised for the worst week since April.

“Today’s release is best characterized as ‘bad news is bad news’ in our view,” said Jeff Schulze, head of economic and market strategy at ClearBridge Investments. “With job creation at stall-speed levels and the tariff headwind lying ahead, there’s a strong possibility of a negative payroll print in the coming months which may conjure up fears of a recession.”

Geopolitical tensions added to the risk-off tone across markets. Trump said he ordered nuclear submarines to be deployed “in the appropriate regions,” citing “highly provocative” remarks from former Russian President Dmitry Medvedev.

The market action marked a sharp reversal from July, when the dollar rallied, haven trades were abandoned and US equities outpaced their international peers, buoyed by robust earnings and a still‑healthy economic growth.

By week’s end, that narrative looks far more tenuous. Trump’s new tariffs — lifting the average US levy on global imports to 15%, the steepest since the 1930s — landed just as data showed that job growth averaged a paltry 35,000 in the last three months, the worse since the pandemic in part due to Trump’s efforts to pull back spending. The prospect for a slowdown caused traders to ratchet up the likelihood for a rate cut in September to 88%, up from 40% earlier this week.

‘Eyes on the Exit’

“Lots of folks have their eyes on the exit door,” said Joe Saluzzi, co-head of equity trading at Themis Trading. “Weak job numbers should solidify the rate cut story for September, but there is some worry that the Fed is waiting too long.”

The specter of lower rates sent the dollar down as much as 1%, the worst intraday drop since April. Economically sensitive companies led the retreat in the S&P 500 amid growth angst. The Russell 2000 Index of small-caps extended declines for a fifth day, poised for the worst week in four months.

The latest data, which also showed that US manufacturing contracted by the most in nine months, casts into sharp relief the conundrum that Powell, and rest of the Fed’s rate-setting committee, face in the weeks and months ahead, as Trump and his administration ramp up their criticisms that the central bank isn’t moving quickly enough to lower rates.

Many economists have noted that Trump’s punitive tariffs and his attempt to single-handedly rewrite the rules of international trade are now undermining the economy that lower rates would help support — by raising the cost of production for US companies and imposing a tax on ordinary Americans. At the same time, those very tariffs may spur a pickup in inflation, which could prevent the Fed from easing, even as the labor market weakens.

The current state of play has undercut investor confidence in the direction of the US economy, and by extension, where asset prices are headed.

Volatility whipped up across markets as traders re-assessed the economic reality after $15 trillion was added to equity values since April. The Cboe Volatility Index, a gauge of equity options cost, jumped above the widely watched level of 20 for the first time since April’s tariff-induced rout. Similar measures on high-yield and investment-grade bonds also climbed.

“Investors may have gotten too complacent while waiting for the impacts of slower economic activity resulting from tariffs and higher interest rates,” said Charlie Ripley, senior investment strategist for Allianz Investment Management. “The economic cooling associated to tariffs is beginning to take hold. Softer labor conditions should raise eyebrows at the Fed and knowing they have been a reactionary organization in recent years, we should expect a higher chance of Fed action in the coming months.”

The dual retreat in the US dollar and equities is a reminder that American assets aren’t impervious to economic and geopolitical shocks. Betting against the dollar — voted as the “most crowded trade” for the first time on record in Bank of America Corp.’s survey of money managers — turned out to be one of the biggest blunders as the greenback posted its first monthly gain since Trump took office. US skeptics, who continued to dominate in BofA’s survey, also had a setback in stocks as the S&P 500 outperformed the rest of the world for a third straight month.

Significant Negatives

The renewed weakness likely marked a welcome development to those who stuck to a preference in non-US assets of late. Rich Weiss, chief investment officer for multi-asset strategies at American Century Investment Management, has continued to be underweight US equities, citing stretched valuations.

“There are significant potential negatives out there with the deficit, tariffs and inflation,” he said. “The overall volatility, which President Trump himself induces into the whole equation, indicates we still should remain somewhat cautious.”

The whiplash between the America First trade and doubts on the strength of the US economy is creating headaches for money managers who are already struggling to keep up with fast-shifting market narratives.

Take those who make investments based on macroeconomic and market trends. The HFRX Macro/CTA Index is down 3% this year, poised for the worst annual performance since 2018.

“While growth had been firm and investors had become more sanguine on tariffs in recent months, the combination of today’s weak employment report and the tariff uncertainty is challenging,” said Jeffrey Palma, head of multi-asset solutions at Cohen & Steers. “This backdrop is a reminder that there are big risks ahead.”

–With assistance from Sid Verma.

(Updates market moves, adds more context and commentary throughout.)

Most Read from Bloomberg Businessweek

©2025 Bloomberg L.P.