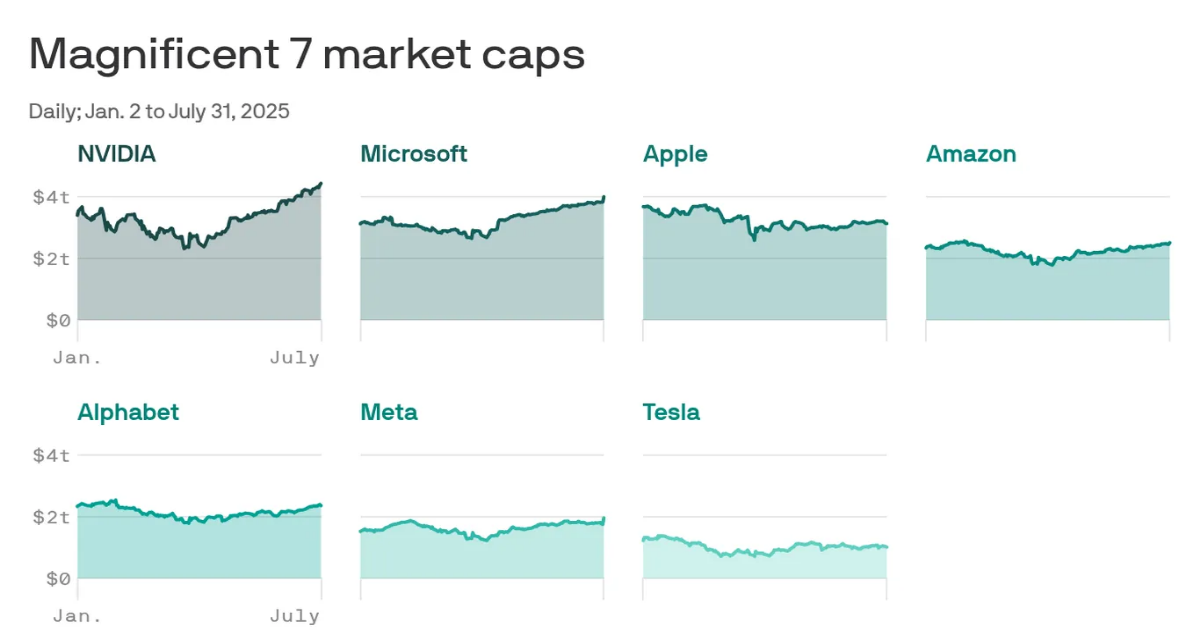

Driving the news: Meta and Microsoft reported blowout quarterly earnings results late Wednesday, exceeding Wall Street’s best estimates for earnings growth and guidance.

- The subsequent stock rally brought Microsoft’s market cap above $4 trillion.

- Since the launch of ChatGPT in 2022, Microsoft’s stock is up 110%, vastly outpacing the broader market’s 56% gain in the same time period.

Be smart: It’s hard to visualize $4 trillion, but let’s try.

- If Nvidia and Microsoft were countries, they’d have the fourth and fifth largest GDPs in the world, respectively.

- Nvidia is worth the equivalent of 14% of the U.S. GDP.

- If you stacked $4 trillion in $100 bills, you could reach the edge of space and back 10 times.

What they’re saying: “These massive results seen by Microsoft and Meta further validate the use cases and unprecedented spending trajectory for the AI Revolution,” Dan Ives wrote in a note to clients.

- Nvidia and Microsoft are the poster children of the AI revolution, Ives said, though broadly tech stocks are poised to continue moving higher over the next 12 to 18 months.

Zoom in: With Microsoft trading at 40 times forward earnings, some investors are ringing alarm bells, saying the stock is too expensive based on its earnings trajectory.

- Tech bulls like Ives would argue that if you worry about valuations, you’ll always miss tech revolutions, as historically these stocks tend to get overvalued on a price basis.

Yes, but: Overvalued stocks are often the first to correct in a market downturn, David Kelly, chief global strategist at JPMorgan, tells Axios.

- “The most lofty tech companies are very exposed to something going wrong here,” he said, noting he sees a “significant correction” coming for the market given valuations at these levels.

What we’re watching: Valuation concerns aren’t stopping investors from pushing other Big Tech names closer to the $4 trillion club.

- Apple is the closest based on price, but its stock is down over 14% year to date.

- With the company set to report earnings Thursday evening, the bar is now even higher for a winning AI story, which Apple has so far failed to deliver.

- Amazon is behind Apple, though it needs an additional $1.5 trillion added to its market cap to catch up.

The bottom line: When companies get as big as major global economies, valuation concerns are natural.

- Tech bulls argue if you worry about price, you’ll miss out on gains.

- Strategists and portfolio managers tell Axios that prices at these levels are doomed for a pullback.