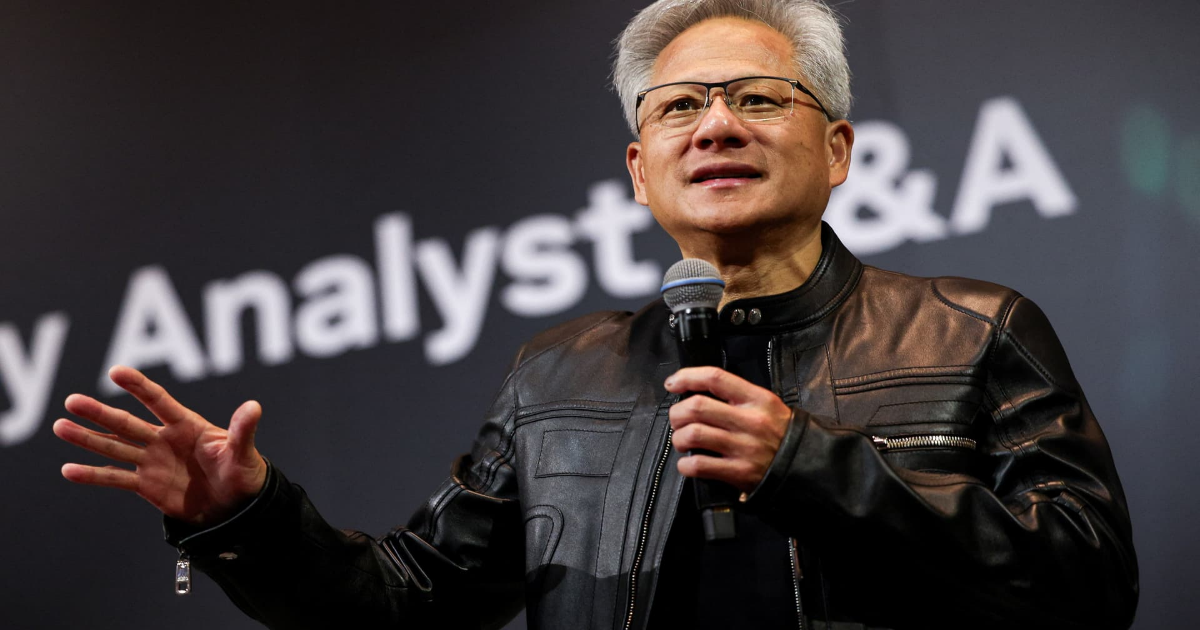

Nvidia CEO Jensen Huang attends a roundtable discussion at the Viva Technology conference dedicated to innovation and startups at Porte de Versailles exhibition center in Paris on June 11, 2025.

Nvidia stock rose on Wednesday lifting the company’s market cap briefly past $4 trillion for the first time as investors scooped up shares of the tech giant building the bulk of the hardware for the generative artificial intelligence boom.

However, Nvidia stock ended finishing the day only up 1.79%, giving the company a market cap of $3.97 trillion.

Nvidia is the world’s most valuable company, surpassing Microsoft and Apple, both of which hit the $3 trillion mark before Nvidia. Microsoft is also one of Nvidia’s biggest and most important customers. The chipmaker is the first company to ever achieve this market value during trading.

The California-based company, which was founded in 1993, first passed the $2 trillion mark in February 2024, and surpassed $3 trillion in June.

Nvidia has profited heavily from the growing demand for AI hardware and chips since the launch of ChatGPT in late 2022. The company has positioned itself as the decisive leader in creating the graphics processing units that power large language models.

The surge in demand has boosted shares in the chipmaking behemoth more than fifteenfold over the last five years. Nvidia’s shares are up more than 15% over the last month and 22% since the start of the year.

The recent rally in Nvidia has come despite geopolitical tensions and ongoing chip curbs that have hampered sales to China. Nvidia has also recovered from fears sparked by China’s DeepSeek model earlier this year that future AI wouldn’t need so many chips.

In May, Nvidia said that a recent export restriction on its H20 chips created for China would cost it $8 billion in lost sales.

“The $50 billion China market is effectively closed to U.S. industry,” Huang said during a May earnings call.

Huang previously told CNBC that getting blocked from selling chips in China would be a “tremendous loss” for the company.

Correction: In May, Nvidia said that a recent export restriction on its H20 chips created for China would cost it $8 billion in lost sales. An earlier version misstated the timing.