U.S. Treasury yields jumped Tuesday morning after Treasury Secretary Scott Bessent announced the start of the formal selection process for a new Federal Reserve head.

Powell said that President Trump is not planning to fire Fed Chair Jerome Powell but the announcement still lifted the 10-year yield close to 4.47% for the first time in a month.

Inflation data was in line with economists’ projections and earnings from major banks slightly beat expectations, but pessimistic forecasts for the second half of the year weighed down most bank stocks except Citigroup.

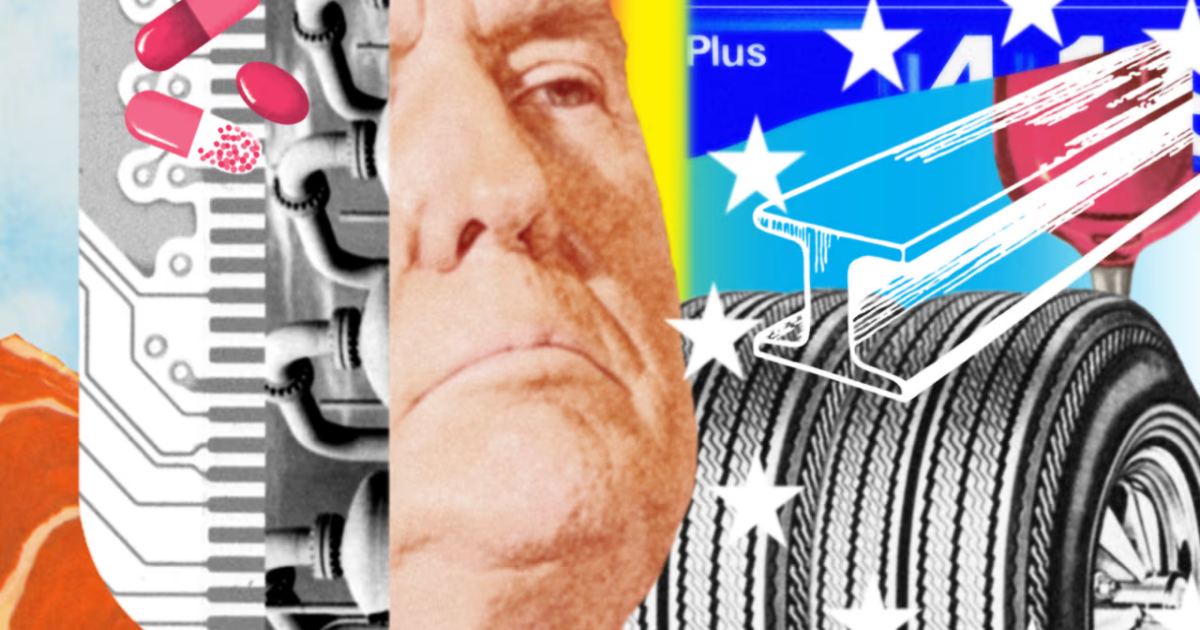

June’s consumer-price index showed annual inflation rising to 2.7%. That’s in line with forecasts and unlikely to sway the Federal Reserve’s course on rates, despite President Trump’s oft-voiced criticism of the central bank.

The S&P 500 and Nasdaq Composite both hit new intraday highs in morning trade, boosted by a rally in chip stocks. That came after semiconductor maker Nvidia said it had received assurance from the White House it can sell H20 chips in China again.

President Trump has landed a trade pact with Indonesia, he wrote on his Truth Social platform without providing details of the deal. The announcement follows a letter Trump sent on July 7 threatening to set a 32% tariff on Indonesian goods.

The Dow industrials fell, while the S&P and Nasdaq rose.

Nvidia stock rose around 5%. Other chip stocks also rose, as did Hong Kong tech shares.

Treasury yields jumped , with the 10-year yield at 4.46%.

Bitcoin prices dropped, after hitting an all-time high Monday above $123,000. The House of Representatives is due to consider three bills on cryptocurrency policy this week.

📧 Get smarter about markets with our free weekday morning and evening newsletters.